A comparative analysis of centralized governance structures in the electric power industries of Myanmar and Thailand

Author: SOE KO KO AUNG

Advisor: Warathida Chayapa & Wongkot Wongsapai

KEY MESSAGES

- Myanmar and Thailand adopt centralized governance in their power sectors, with Thailand aligning its sector with international trends, whereas Myanmar stays to a more traditional governance framework.

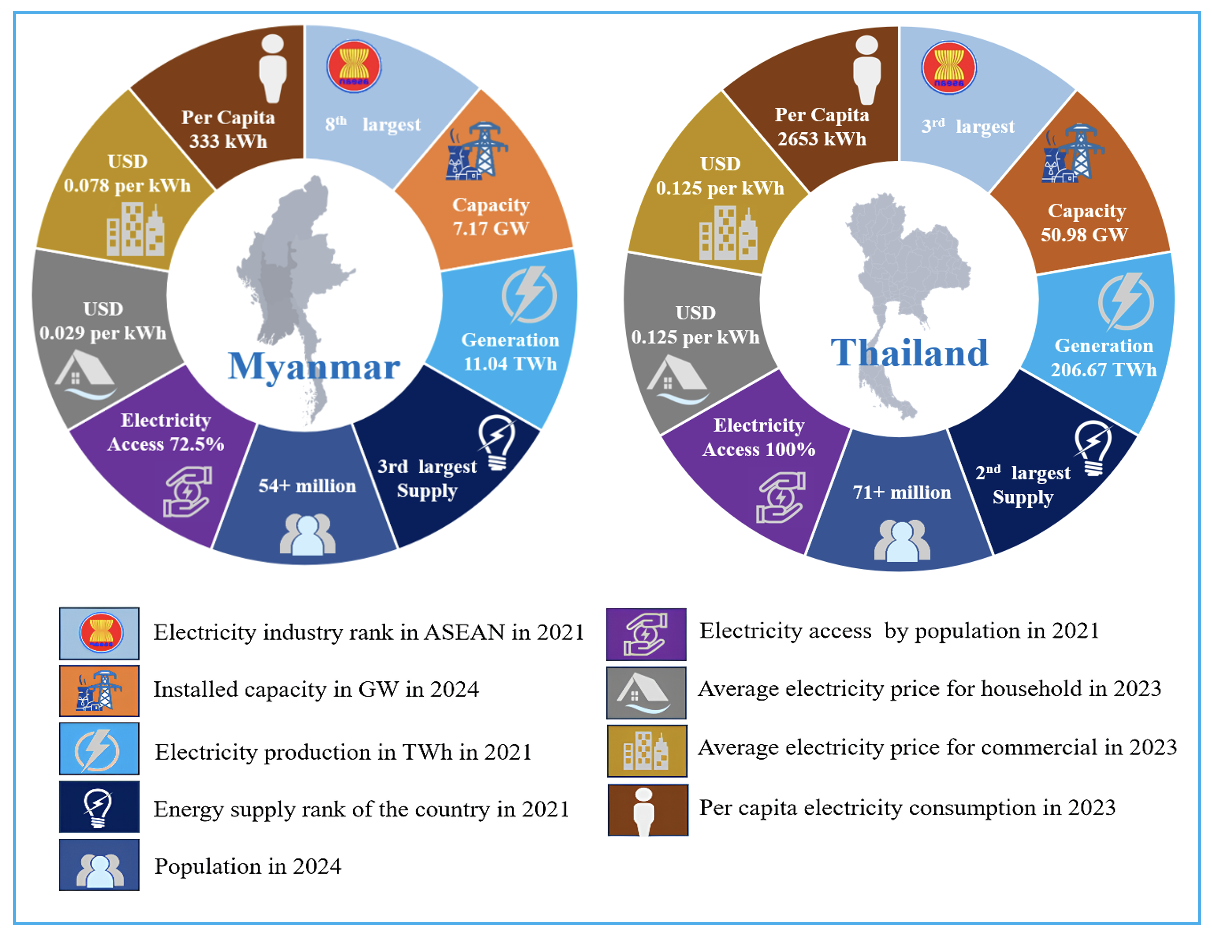

- Thailand has an installed capacity seven times greater than Myanmar’s, producing twenty times more electricity with eight times higher per capita consumption, while Myanmar continues lower electricity prices.

- Thailand’s governance structure comprises seven reliable, six ineffective, and four distinctive features, while Myanmar’s includes one reliable, four ineffective, and two distinctive features.

- To improve governance structures in Thailand, four main recommendations have been identified: the impact of the “Establishment,” clear agreements between policy departments and State-owned Enterprises to maintain pricing stability, regulatory changes to remove favouritism towards state-owned entities, and learning from Myanmar’s experiences.

- To improve governance structures in Myanmar, four essential recommendations have been put forward: establishing a bipartisan agreement on energy policies, amending and upholding electricity regulations, adopting a merit-based approach to recruitment for competent leadership, and learning from the experiences of Thailand.

Governance challenges in the power sectors of Myanmar and Thailand

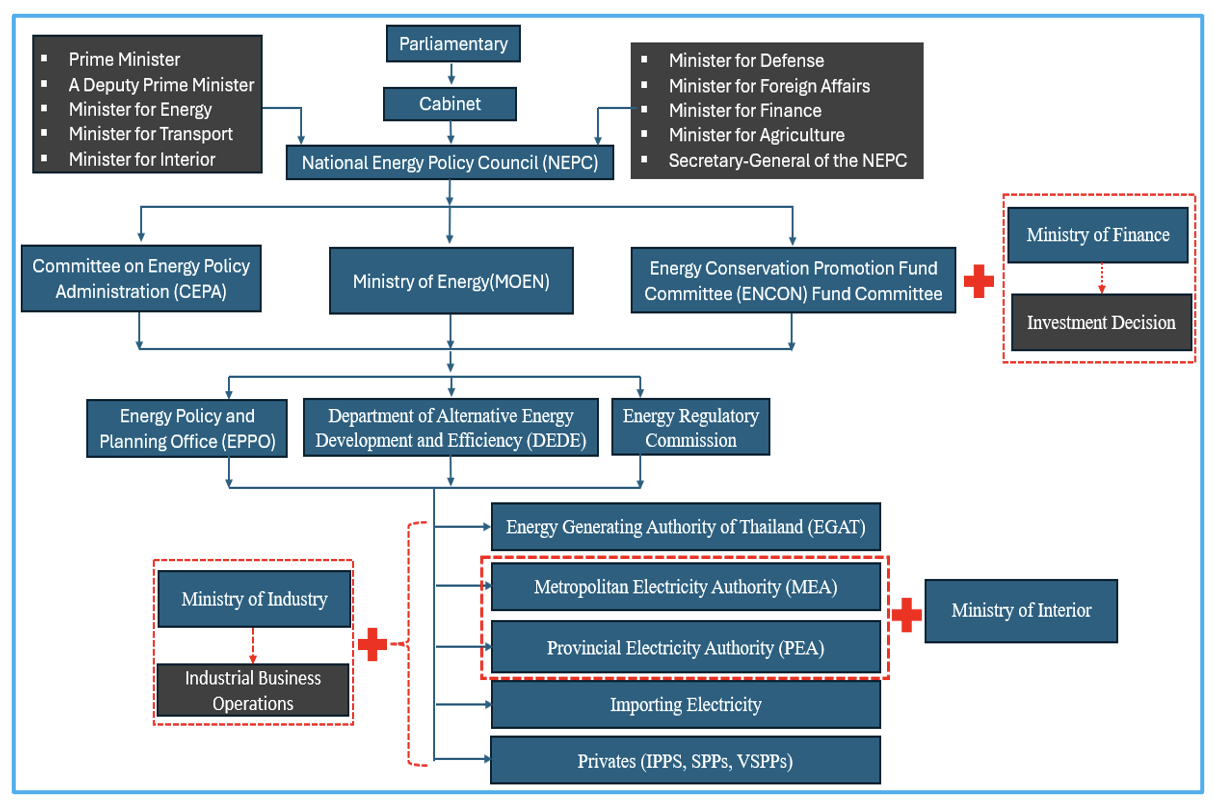

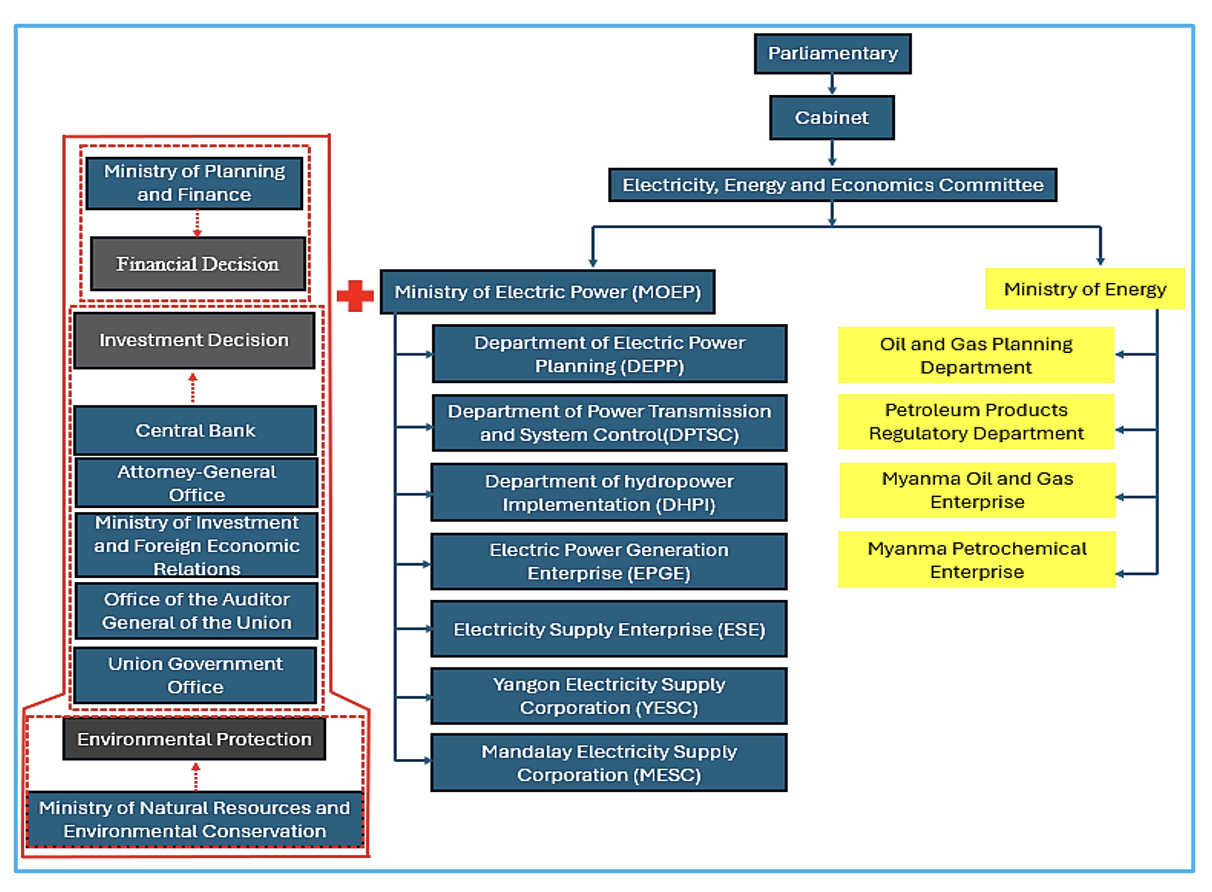

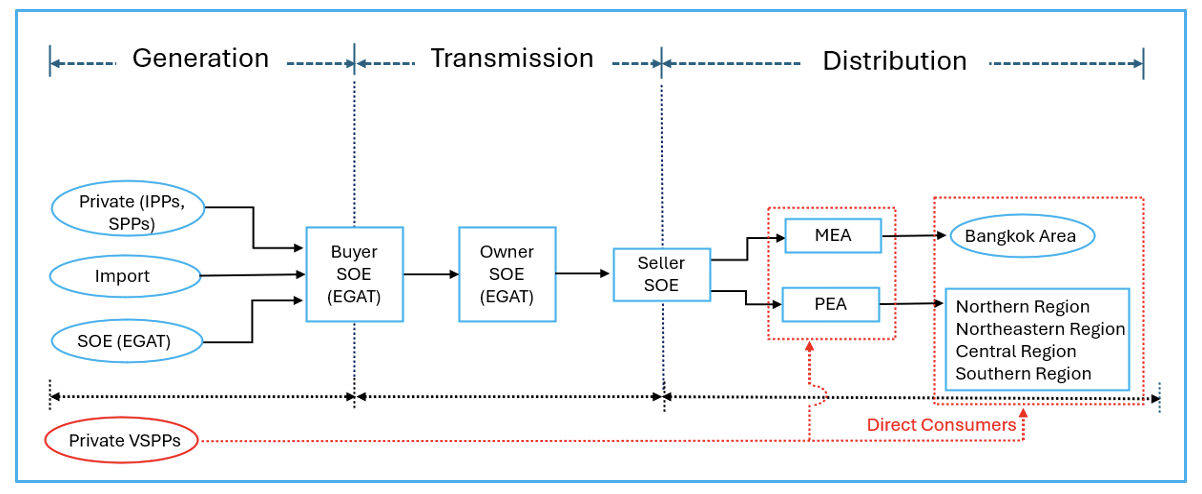

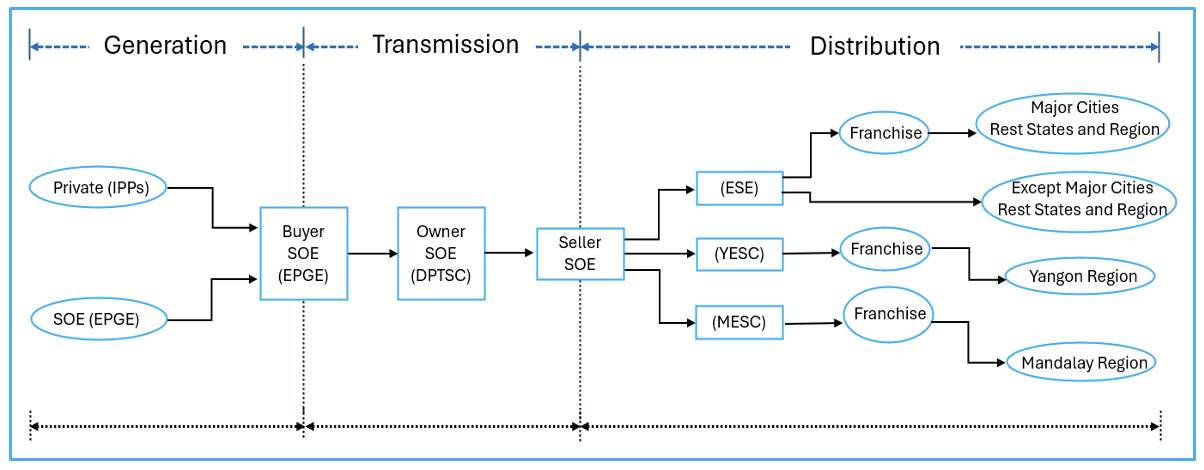

Power sector plays a significant role in the energy supply of Myanmar and Thailand, ranking as the second highest in Thailand (Kamalad,2021) and the third highest in Myanmar (Myint, 2021). In the power sectors of both countries, various government organizations are involved in a top-down decision-making process that influences governance and policies as shown in Figures 1 and 2. Both countries adopt a single-buyer model dominated by state-owned enterprises as shown in Figures 3 and 4. Despite differing industry profiles, Myanmar and Thailand have adopted a centralized governance approach in the power sector.

The landscape of the global power sector, as a prominent energy source, is experiencing substantial changes because of environmental (International Energy Agency,2024), economic, and technological progress (International Energy Agency,2022). These changes present complex difficulties to energy security, sustainability, and affordability (McKinsey&Company,2023). It is necessary to have effective governance in the power sector during this evolving environment. Adapting governance frameworks to address these challenges is crucial, as outdated models may result in negative consequences. Traditional approaches are necessary to align with modern developments and accomplish long-term goals.

Despite Thailand having a strong power sector and Myanmar having a weaker one as described in Figure 5, both countries face institutional and governance challenges. Thailand struggles with conflicts of interest at the national level, a favouritism framework towards state-owned enterprises, dependencies on regulatory commissions and energy conservation funds, and a lack of public sector representation in decision-making (Nuntavorakarn, 2018). Meanwhile, Myanmar faces with disparities in authorized power between national and regional levels, a need for comprehensive wisdom, decision-makers associations with self-interested business practices, a culture of stagnation, and an ineffective linkage between strategies and implementation.

Currently, the governance structure of Thailand is dominated by fossil fuel-centric policies and centralized market barriers that hinder the development of electricity production from large-scale renewable power, despite its goal to become the ASEAN hub for renewable energy (Sirasoontorn & Koomsup,2017). Conversely, Myanmar is struggling with chronic electricity shortages and widespread system failures, signalling a sluggish development (World Bank,2023).Given these distinct circumstances, it indicates exploring ways to enhance governance structures to align with global perspectives and meet the long-term goals on power sector. Therefore, identifying the elements that findings in the success or failure of the power sectors in individual countries is important.

Figure 1: National governance framework in Thailand

Figure 1: National governance framework in Thailand

Source: Sirasoontorn and Koomsup, 2017

Figure 2: National governance framework in Myanmar

Source: Ministry of Electric Power (Unpublished)

Figure 3: The power market structure in Thailand

Source: Electricity Generation Authority of Thailand, 2020

Figure 4: The power market structure in Myanmar

Source: Ministry of Electric Power (Unpublished)

Figure 5: Key metrics of the power sectors of Myanmar and Thailand

Source: Developed by Researcher

A comparative analysis of centralized governance in the power sectors of Myanmar

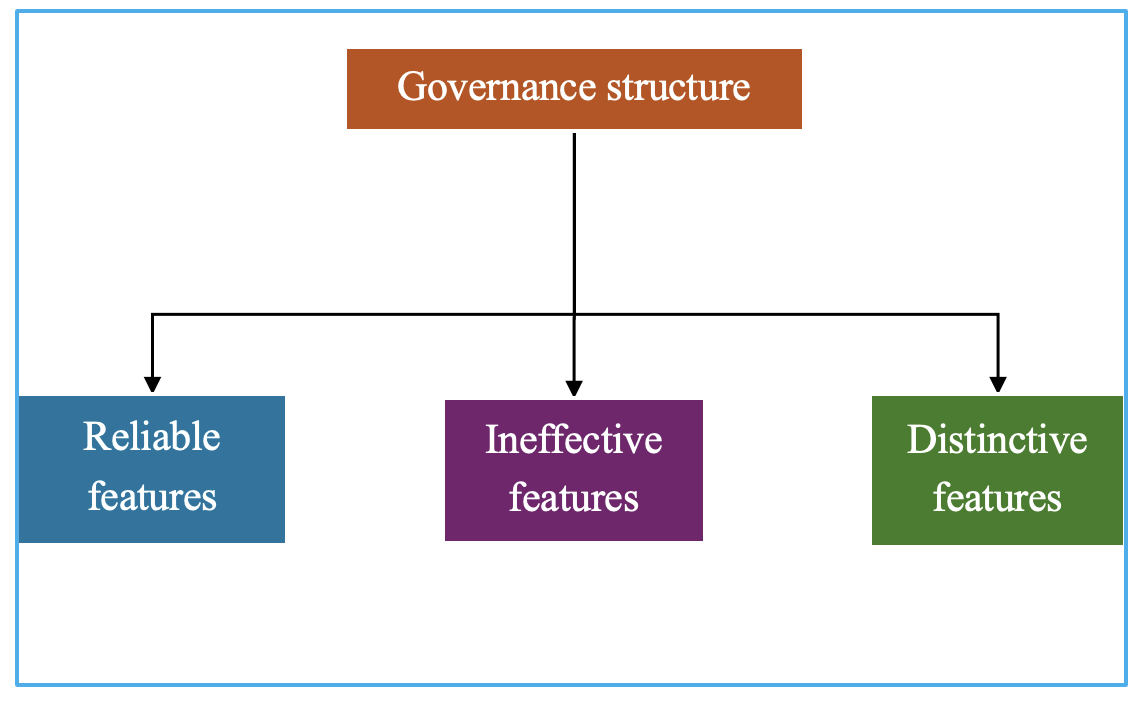

- The Analytical framework by Esser and Hanitzsch (2012)provided a comparative analysis of governance structures, evaluating reliable, inefficient, and distinctive features as shown in Figure 6, providing insights into practices to adopt and avoid for optimal results. Both countries need to change and adapt to new approaches that align with their national interests and public, rather than solely focusing on a centralized governance structure. By exchanging knowledge and learning from each other’s experiences, Myanmar and Thailand can enhance their governance structure.

This framework examines the answers to the question “How do the centralized governance structures differ in the sectoral performance of the power sectors in Thailand and Myanmar, and how can insights from this comparison be used to improve sector performance in both countries?”

Figure 6: A comparative analysis for governance structures

Source: Esser & Hanitzsch, 2012

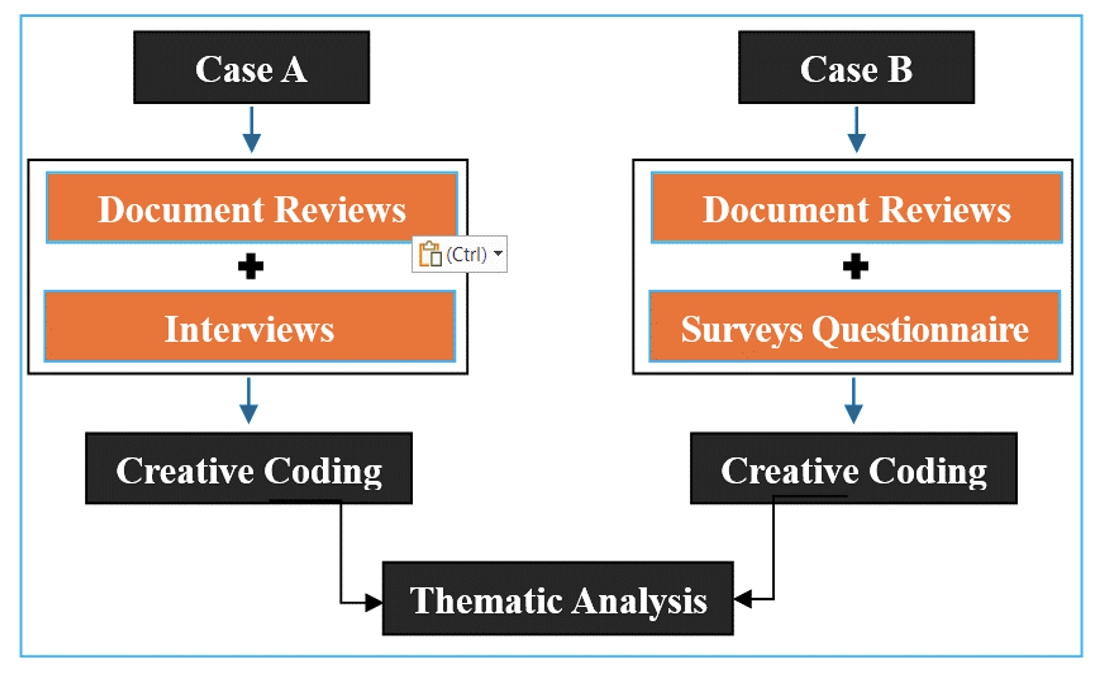

- The findings, characteristics of both countries, were derived from a qualitative approach using multiple case studies, document analysis, and surveys to gather data from primary and secondary sources. Survey respondents included researchers, government officials, energy sector professionals, and policy experts from Myanmar and Thailand. Creative coding by “MAXQDA” and thematic analysis was used for interpretation as shown in Figure 7.

Figure 7: Data collection and analysis methods

Source: Developed by Researcher

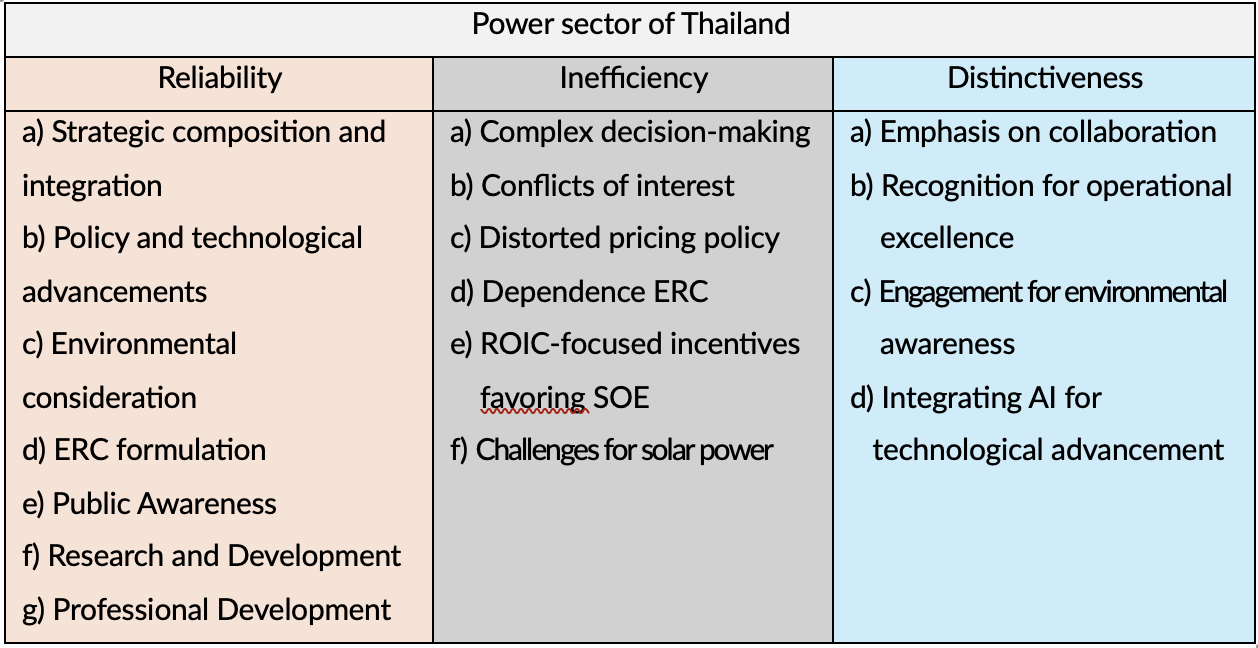

Characteristics of the governance structure in Thailand’s power sector

In Thailand’s sector, seven reliable features, six ineffective features, and four distinctive features have been recognized as the following:

The reliable features are:

- Linking strategic planning with associated planning ensures reliability. Incorporating frameworks such as the Strategy Framework (2017-2036) and Sustainable Development Goals into the Thailand Integrated Energy Plan (TIEP) increases reliability.

- Policy changes are mainly influenced by technological progress and worldwide trends. Initiatives like Feed-in Tariffs (FiTs) from 2015 onwards assist the industry’s performance and sustainability.

- The aim is to attain a 20% decrease in greenhouse gas emissions by 2030, with a focus on environmental factors. To achieve this objective, multiple initiatives such as the Power Development Plan, Energy Efficiency Plan, Alternative Energy Development Plan, the Gas Plan, and Oil Plan are implemented within the TIEP framework to guarantee reliability.

- The Energy Regulatory Commission is responsible for overseeing electricity tariffs, granting licenses, and setting customer service standards. Temporary committees are also established to enhance performance, demonstrating the importance of clear roles and responsibilities in improving sector performance.

- Public communication and education play a crucial role in enhancing awareness by implementing strategic planning and technology dissemination. This is achieved through various means such as platforms, educational centres, events, booths, and school programs, all of which contribute to raising public awareness. Moreover, research and development initiatives, backed by energy funds and the Program Management Unit (PMU), encourage collaboration for the advancement of innovative technologies. Additionally, the professional growth of ERC staff is fostered through international education and inter-forum meetings, which in turn shape policy development and professional standards.

Table 1: Characteristics of the governance structure in Thailand’s power sector

Source: Developed by Researcher

The ineffective features include:

- Complex decision-making among governmental bodies causes high costs and conflicts. There are conflicts of interest from dual roles of senior officials at the national level.

- The electricity pricing policy becomes distorted during fuel price crises.

- The ERC is influenced by the Ministry of Energy and National Energy Policy Council, which limits independence and affects ERC’s inefficiencies.

- Incentives focused on Return on Invested Capital (ROIC) favor large-scale investments by State-Owned Enterprises (SOEs). Solar power faces challenges due to inconsistent incentives, lengthy licensing processes, and poor sector coordination.

The distinctive features are:

- Collaboration and partnerships play a significant role in promoting sustainable energy and environmental stewardship through a range of public awareness initiatives. The sector’s notable efforts include educational programs and community engagement to raise awareness about environmental concerns.

- Furthermore, the industry’s commendable practice of recognizing operational excellence through national and international awards is creditable. Advocating for policy flexibility and improving market dynamics is another positive aspect.

- The Alternative Energy Development Plan (AEDP), which aims to achieve 20% renewable energy by 2036, showcases a strong commitment to environmental preservation. Additionally, sustainability initiatives such as the suspension of new domestic hydropower projects and the utilization of AI for technological advancements aim to further enhance the sector’s performance.

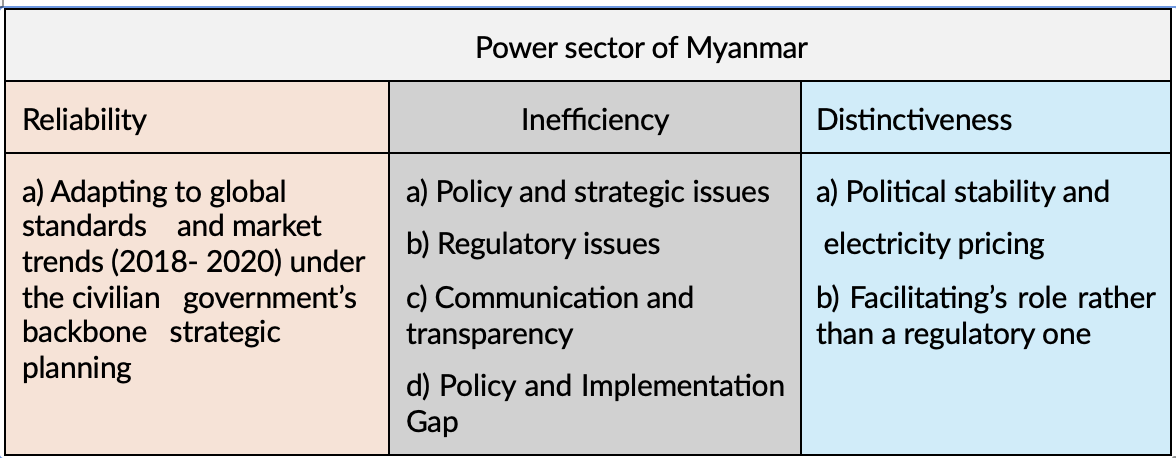

Characteristics of the governance structure in Myanmar’s power sector

In Myanmar’s industry, one reliable feature, four ineffective features, and two distinctive features have been recognized as the following:

One reliable feature in the power sector of Myanmar is:

- Between 2018 and 2020, Myanmar’s power sector advanced significantly under the civilian government’s Backbone Strategic Planning and the Myanmar Sustainable Development Plan 2018-2030. Short-term and long-term planning were interlinked with the backbone strategic planning. These efforts increased electrification rates, attracted substantial Foreign Direct Investment (FDI) in the power sector, and ensured continuous electricity supply. However, it was disrupted by the military coup

Table 2: Characteristics of the governance structure in Myanmar’s power sector

Source: Developed by Researcher

The ineffective features in the power sector of Myanmar are:

- As of 2021, political unrest and changing interests have led to frequent policy changes. This focus on immediate issues has neglected long-term objectives and established frameworks. The resulting inconsistency and failure to build on previous strategies have negatively impacted the power sector’s performance.

- The 2014 Electricity Law proposed the Electricity Regulatory Commission, approved by the Pyidaungsu Hluttaw, one of three parliament, and to be overseen by a presidential appointee. This commission aimed to enhance the electricity industry, attract investments, enforce regulations, promote transparency, and set tariffs. Despite its approval, the commission has not been established, leading to power struggles among government bodies, hindering cooperation and governance, and resulting in a performance shortfall within the power sector.

- Poor communication and transparency between the government and the public are affecting public engagement in planning, technology, environment, and pricing.

- Although plans and strategies may appear well-designed in theory, they often lose from their intended plan due to mismanagement by individuals who have personal connections to those in positions of power. Decisions influenced by personal interests, bureaucratic management practices, and inadequate HR administration hinder operations. The weak legal framework adds complexity to decision-making and regulatory clarity. The 2014 Electricity Law only provides a general framework, lacking specific regulations on tariffs, legal terms, and environmental aspects. Negotiations frequently fail to resolve issues. The absence of granted laws for public-private partnerships (PPP) in large-scale power projects and an untested legal environment further complicate investment prospect.

The distinctive features in the power sector of Myanmar are:

- The primary focus has been on maintaining political stability and ensuring affordable electricity prices based on socialist principles. However, the lack of price adjustments by successive governments has caused financial constraints. This has had a negative impact on the development of the power sector, straining public finances.

- Outdated laws have significantly affected Myanmar’s electricity industry. The lack of sufficient regulatory frameworks has placed the responsibility for resettlement on investors, while the government has shifted towards a facilitating role rather than a regulatory one. Despite the 2016 Public Debt Management Law addressing financial liabilities, it rarely applies to sovereign guarantees in foreign direct investment projects, except for government-to-government (G-to-G) projects.

- Efforts have been made to align with international financing regulations, yet uncertainties remain in environmental compliance, land use policies, and the enforcement of secured interests. Such a situation obstructs international standards and the legitimacy of organizations, giving a free pass to unaccountable countries and organizations.

Conclusion and Recommendations

Recommendations for Thailand

There are four recommendations aimed at improving the governance structure of Thailand’s power sector.

- The first suggestion emphasizes the dominant role of the “Establishment” in shaping government energy policies. This influential group, overseeing energy corporations and government-related entities, avoids direct intervention but determinedly opposes decisions that could undermine their interests. Thus, aligning energy policies with the “Establishment’s” direction is crucial.

- The second highlights the necessity of well-defined agreements between policy departments and power providers to stabilize pricing policies and protect state-owned enterprises (SOEs) from fuel price crises. These agreements should cover factors like operational costs, inflation rates, and pricing methodologies based on regional Brent oil market norms, commonly used in Thailand. Such measures can shield SOEs from unexpected electricity price fluctuations amid volatile fuel prices.

- The third emphasizes regulatory reforms to eliminate favouritism towards state-owned entities, address monopolistic behaviours, and encourage fair competition. This includes transparent competitive bidding for new energy projects to create an equitable environment for stakeholders, fostering competitiveness and benefiting consumers.

- Thailand can draw lessons from Myanmar’s challenges, which include weak legal frameworks, personal interests in decision-making, and political instability. By understanding these lessons, Thailand can avoid facing similar issues that have obstructed Myanmar’s power sector growth.

Recommendations for Myanmar

There are four proposals aimed at enhancing the governance structure of Myanmar’s power sector.

- The key recommendation emphasizes the need for bipartisan consensus on energy policies to maintain stability through political changes. This requires a strategic, long-term policy approach aligned with current frameworks for effective implementation.

- The second recommendation proposes revising and enforcing electricity laws to foster a transparent and fair investment climate. This would update regulations, define investor responsibilities clearly, and align standards with international norms for community protection. Enforcing the 2016 Public Debt Management Law, especially in relation to sovereign guarantees in foreign direct investments, aims to enhance transparency and build investor confidence.

- The third proposal aims to improve sectoral performance through better governance and decision-making. It suggests replacing unqualified personnel with competent professionals and ensuring transparent, merit-based recruitment for effective leadership.

- The fourth recommendation suggests adopting integrated strategic planning and establishing an Energy Regulatory Commission, inspired by Thailand’s practices, to enhance sector efficiency. Additionally, promoting public engagement, developing professional standards, and embracing global electric power technology advancements should adapt for long-term success.

In summary, Myanmar’s abundant energy resources alone are insufficient for development; effective governance, efficient management, and political stability are vital. Without these, benefits accrue only to influential actors, leaving most of the population disadvantaged. Past military mismanagement has led to heavy reliance on neighbouring countries for energy and limited regional engagement. Future efforts should prioritize energy self-sufficiency, address short-term and long-term needs, and engage more deeply in regional and global energy dynamics.

References

[1] Esser, F., & Hanitzsch, T. (2012, January). (PDF)… www.researchgate.net.https://www.researchgate.net/publication/281728188_Esser_F_Hanitzsch_T_2012_On_the_Why_and_How_of_Comparative_Inquiry_in_Communication_Studies_In_F_Esser_T_Hanitzsch_Eds_Handbook_of_Comparative_Communication_Research_London_Routledge_3-22.

[2] International Energy Agency, IEA. (2022, October 27). World energy outlook 2022 – news. https://www.iea.org/news/world-energy-outlook-2022-shows-the-global-energy-crisis-can-be-a-historic-turning-point-towards-a-cleaner-and-more-secure-future 22.

[3] International Energy Agency, IEA. (2023, August). Thailand’s Clean Electricity Transition – analysis. https://www.iea.org/reports/thailands-clean-electricity-transition

[4] International Energy Agency, IEA. (2024, January). Electricity 2024 – analysis. https://www.iea.org/reports/electricity-2024

[5] Kamalad, S. (2021b, March). Chapter 16. Thailand Country Report. energy Outlook and Energy Saving Potential in East Asia 2020. https://www.eria.org/uploads/media/Books/2021-Energy-Outlook-and-Saving-Potential-Eas

t-Asia-2020/23_Ch.16-Thailand-1603.pdf historic-turning-point-towards-a-cleaner-and-more-secure-future 22.

[6] McKinsey & Company, M. & C. (2023, October 18). Global Energy Perspective 2023. McKinsey & Company.https://www.mckinsey.com/industries/oil-and-gas/our-insights/global-energy-perspective-2023

[7] Myint, T. Z. (2021, March). Chapter 12. Myanmar Country Report. Energy Outlook and Energy Saving Potential in East Asia 2020. https://www.eria.org/uploads/media/Books/2021-Energy-Outlook-and-Saving-Potential-East-Asia-2020/19_Ch.12-Myanmar.pdf

[8] Nuntavorakarn, S. (2018, December 3). Southeast Asia Regional Office. Heinrich Böll Foundation | Southeast Asia Regional Office. https://th.boell.org/en/2018/12/03/institutional-and-governance-aspect-energy-transition-case-thailand

[9] Sirasoontorn,P.,& Koomsup , P. (2017). Energy transition in Thailand – bibliothek derFriedrich-Ebert…www.asus.com.https://library.fes.de/pdf-files/bueros/thailand/13888.pdf *

Download full article >>> Click